Get the free ct 1041 extension instructions form

Show details

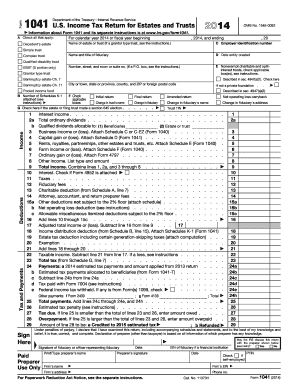

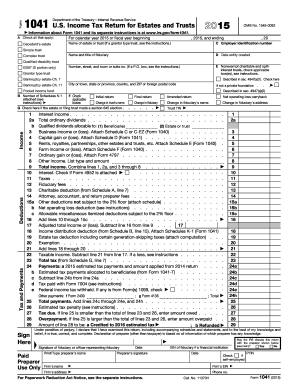

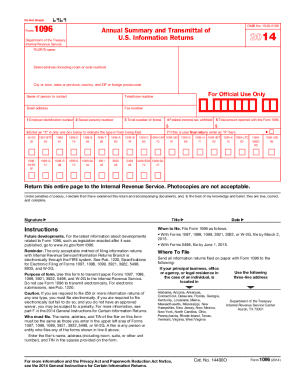

1. Connecticut taxable income of duciary from Schedule CT-1041C Line 14 or to Quick-File see federal Form 1041 Line 22. 7. Add Line 5 and Line 6. 8. Adjusted net Connecticut minimum tax credit from Form CT-8801 12. Payments made with extension request on Form CT-1041 EXT 14. Write the FEIN of the trust or estate and 2008 Form CT-1041 on the check. The Department of Revenue Services DRS may submit your check to your bank electronically. Department...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ct 1041 extension instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 1041 extension instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct 1041 extension instructions online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form ct 1041. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out ct 1041 extension instructions

How to fill out ct 1041 extension instructions:

01

Obtain the ct 1041 extension form from the appropriate tax authority, such as the Internal Revenue Service (IRS) or your state tax agency.

02

Carefully read the instructions provided with the form to familiarize yourself with the requirements and deadlines for filing an extension.

03

Gather all the necessary information and documents that will be needed to complete the extension form. This may include personal information, details about the estate or trust, and relevant financial information.

04

Fill out the ct 1041 extension form accurately and completely, ensuring that all required fields are properly filled in. Double-check your entries to avoid any errors that may lead to processing delays or penalties.

05

If applicable, attach any additional supporting documentation or schedules that may be required by the tax authority. This could include copies of previous tax returns, financial statements, or other relevant information.

06

Review the completed form and all attached documents to ensure they are accurate and complete. Make any necessary corrections or additions before submitting the extension request.

07

Submit the ct 1041 extension form to the appropriate tax authority by the designated deadline. Be sure to follow the specified submission method, whether it is through mail, electronically, or any other approved means.

08

Keep a copy of the completed extension form and all related documents for your records. This will be helpful in case of any inquiries or audits in the future.

Who needs ct 1041 extension instructions?

01

Executors of estates or trustees of certain types of trusts who are unable to file the ct 1041 tax return by the original due date may need ct 1041 extension instructions.

02

Individuals who require additional time to gather the necessary information and complete the ct 1041 tax return accurately may also benefit from ct 1041 extension instructions.

03

It is important to consult with a tax professional or advisor to determine if filing an extension is the appropriate course of action in your particular situation. They can provide guidance based on your specific circumstances and help ensure compliance with all applicable tax laws and regulations.

Fill form : Try Risk Free

People Also Ask about ct 1041 extension instructions

Does Connecticut require a separate extension?

What form do I need to file an extension for 1041?

Can you file an extension for an estate tax return form 1041?

How do I file a CT extension?

Does CT 1041 accept federal extension?

Does Connecticut give automatic extension?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct 1041 extension instructions?

CT 1041 is a tax form used by residents of Connecticut to report income and calculate their state income tax liability for an estate or trust. If you need more time to complete this form, you can request an extension by filing Form CT-1041 EXT, Application for Extension of Time to File Connecticut Income Tax Return for Trusts and Estates.

The extension instructions for Form CT-1041 EXT provide guidelines and requirements for requesting additional time to file your tax return. Here are some key points typically covered in the instructions:

1. Deadlines: The regular due date for filing the CT 1041 form is the 15th day of the fourth month following the close of the tax year (April 15th for individuals). If you need an extension, you must file Form CT-1041 EXT before the original due date.

2. Duration of Extension: If approved, the extension will generally provide an additional six months to file the CT 1041 form, making the new deadline October 15th.

3. Filing Process: You can file Form CT-1041 EXT electronically through the Connecticut Taxpayer Service Center (TSC) or by mail. The instructions provide details on how to file using either method.

4. Payment Requirement: Although the form grants an extension for filing, it does not grant an extension for payment of any tax due. If you anticipate owing taxes, it is generally recommended to make an estimated payment by the original due date to avoid interest and penalties.

5. Late Filing Penalty: If you fail to file Form CT-1041 EXT or file it after the original due date without reasonable cause, you may be subject to a penalty. The extension instructions outline the penalty amounts and criteria for reasonable cause.

It is important to review the specific instructions for Form CT-1041 EXT provided by the Connecticut Department of Revenue Services for the most accurate and up-to-date information.

Who is required to file ct 1041 extension instructions?

The fiduciary or trustee of an estate or trust is generally required to file Form CT-1041 (Connecticut Income Tax Return for Trusts and Estates). If the fiduciary or trustee needs more time to file the tax return, they may request an extension by filing Form CT-1041 EXT (Connecticut Application for Extension of Time to File Connecticut Estate and Trust Income Tax Return).

How to fill out ct 1041 extension instructions?

To fill out CT-1041 extension instructions, follow these steps:

1. Obtain the CT-1041 extension form: Visit the official website of the Connecticut Department of Revenue Services (DRS) or contact them to acquire a copy of the CT-1041 extension form.

2. Enter taxpayer and estate information: Fill in the taxpayer's name, Social Security number, address, and fiduciary entity name (if applicable). Provide the estate's name, Employer Identification Number (EIN), and address.

3. State the estimated tax liability: Estimate the estate's total Connecticut income tax liability for the tax year. If unsure about the exact amount, make a reasonable estimate based on the available information. Include any prior tax payments made.

4. Calculate the amount of the extension payment: Use the CT-1041 extension form instructions to determine the required payment. This is usually 90% of the total tax liability or 100% of the prior year's tax liability, whichever is lower.

5. Make the payment: Write a check or money order for the amount calculated and payable to the "Commissioner of Revenue Services." Attach the payment to the CT-1041 extension form.

6. File the extension request: Send the completed CT-1041 extension form and the payment to the Connecticut Department of Revenue Services either by mail or electronically. Be sure to retain a copy for your records.

Note: It is important to meet the original tax deadline, even if an extension is requested. Failure to file on time may result in penalties or interest charges. An extension only allows extra time to file the return, not an extension to pay any taxes owed.

What is the purpose of ct 1041 extension instructions?

CT-1041 is a tax form used by estates and trusts to report their income and calculate their tax liability in Connecticut. The purpose of CT-1041 extension instructions is to provide guidance on how to apply for an extension of time to file the CT-1041 form.

The extension instructions outline the process of filing Form CT-1041 EXT to request an automatic six-month extension. It explains the important deadlines, when to file the extension form, and any additional requirements or documentation needed. By following the extension instructions, estates and trusts can ensure they comply with the necessary tax obligations while obtaining extra time to complete their CT-1041 form accurately.

What information must be reported on ct 1041 extension instructions?

According to the instructions for Form CT-1041, the following information must be reported when filing for an extension:

1. Identification information: Provide the name, address, and taxpayer identification number of the estate or trust.

2. Tax year: Indicate the tax year to which the extension request applies.

3. Estimated tax liability: Estimate the total tax liability for the estate or trust for the year, including any balance due.

4. Total payments and credits: Provide the total amount of estimated tax payments and any other credits that have been or will be made.

5. Balance due: Calculate the balance due by subtracting the total payments and credits from the estimated tax liability.

6. Signature: The extension request must be signed by a person authorized to sign on behalf of the estate or trust.

Please note that this information is for general guidance, and it is recommended to refer to the specific instructions provided by the Connecticut Department of Revenue Services for Form CT-1041 to ensure compliance and accuracy.

What is the penalty for the late filing of ct 1041 extension instructions?

The penalty for late filing of CT 1041 extension instructions may vary depending on the specific circumstances and the tax regulations of the state where the filing is being made. It is recommended to consult the official guidance provided by the Connecticut Department of Revenue Services or seek advice from a tax professional to determine the exact penalty amounts and requirements for late filing.

Where do I find ct 1041 extension instructions?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific form ct 1041 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in ct 1041?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your ct 1041 extension instructions to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit form ct 1041 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing ct 1041 right away.

Fill out your ct 1041 extension instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct 1041 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.